Space data : the golden age

The space industry is experiencing unprecedented sectoral growth. Currently valued between US$ 210 and 260 billion, it is projected to double within the next decade. Driven by the so called ‘New Space’ momentum, the willingness to invest, risk, explore and develop space represents incredible opportunity across the whole value chain.

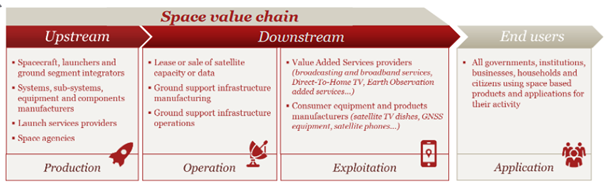

Figure 1: Space value chain (source: IFRI)

While spectacular developments have been observed in the upstream market (e.g. reusable launcher, mega constellations), the downstream sector also entered a profound change driven by improved capabilities and new use cases. The downstream sector which currently accounts for 80%[1] of the global space economy is expected to reinforce its critical role over the next decade.With the advent of “New Space”, a novel ecosystem favoured the emergence of new actors with integrated business models but also changed the way space capabilities are being operated and exploited.

Space data a new Eldorado for the space industry

The three main space components (Satcom, Global Navigation Satellite System (GNSS) and Earth Observation) are all on the rise. Synergies between the three components are increasingly considered bringing additional opportunities to meet end-user needs. Besides, new satellite capabilities and advanced technologies such as AI, big data, blockchains allow novel applications to emerge and further boost the downstream market from data suppliers (lease or sale of satellite capacity or data) to value added service providers and or course equipment manufacturers.

Space data is at the cornerstone of this new era as it unlocks new usage in several sectors such as precision farming, insurance, natural resource management, natural risks monitoring, oil & gas exploration and meteorology. Common to all these use cases it the Earth Observation data.

The Earth Observation downstream market is set to grow steadily across the next decade

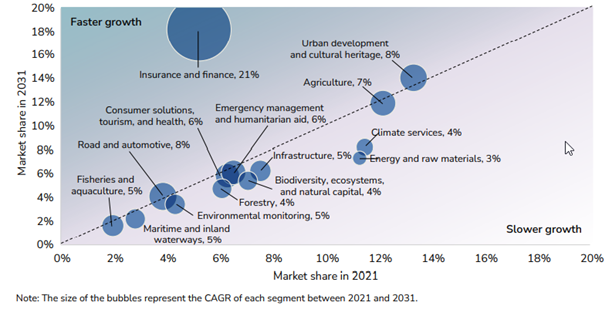

According to the 2022 EUSPA Market Report, revenues of the Earth Observation market are set to double from roughly €2.8 billion to €5.5 billion over the next decade, mainly boosted by value-added services which stand for 85% of the global revenues. Driven by Energy, Agriculture, Urban development and Climate services, all market segments are expected to grow significantly although Insurance and Finance should experience the steadiest growth thanks to the uptake of parametric insurance solutions.

Figure 2: EO Data market share in 2021 & 2031 (courtesy EUSPA 2022 market report)

A wealth of opportunities is therefore expected in the EO data market as performance at user level improves. This performance improvements will be brought by the new satellites launched but also by value added service providers that will propose innovative solutions to their customers.

A new deal of the EO space downstream sector with opportunities to build new business models

The value chain of the EO downstream market can be split into two main parts:

- Data acquisition and distribution where actors supply commercial raw, unprocessed or pre-processed data from satellite, online platforms and data catalogues.

- Data processing where actors provide value added services, develop tailored algorithms and specific applications.

Overall North American and European companies jointly lead the market with equivalent market shares (around 40%). Large companies such as Maxar, Airbus, Leonardo or Amazon are among the key stakeholders in the EO data market, but start-ups are extremely active in the data processing part of the value chain thanks to their flexible approach and accurate knowledge of user needs. According to the latest European Association of Remote Sensing Companies (EARSC) Industry Survey, SMEs and start-ups account for more than 93% of European EO companies, witnessing the huge importance of these actors for the European EO economy.

A wealth of opportunities is therefore expected in the EO data market as performance at user level improves. This performance improvements will be brought by the new satellites launched but also by value added service providers that will propose innovative solutions to their customers.

Our conviction at Mews Partners: we firmly believe in the potential of space data hybridisation as a major growth relay for the space industry!

Since 1992, Mews Partners has forged a unique expertise in the space sector for Agencies, Primes and suppliers of equipment and services. Leveraging a huge track record with the space upstream actors, Mews Partners is also increasingly involved in the downstream sector with a keen interest to accelerate the transformation of innovative ideas into operational services.

For instance, Mews Partners, Eurobios Mews Labs and its partner Kayrros have recently won the CNES R&T challenge on space data hybridisation. Our innovative approach based on Neural radiance field (NeRF) aims to build 3D models from heterogeneous SAR and optical images across different sources. Frédéric Saffar from Mews Partners explains: “our approach is extremely promising in terms of applications from defense, critical infrastructure monitoring, natural disaster assessment, and of course energy and climate services.” A preliminary study conducted by our team already validated the feasibility of the approach. “After having validated the overall concept with our experts we now enter a very exciting phase to improve our algorithms and deliver a real data demonstrator by the end of 2024” says Saffar.

This also reinforces Mews Partners unique positioning on the space sector: Helping our customers to solve their problems, test new concepts, understand the market and embrace complex technologies in the development of their product and service offering. “Not only Mews Partners works alongside the space industry since decades to provide best in class management consulting support but we are able to support our customers with innovative and cutting edge simulation and data modelling capabilities through our Eurobios Mews Lab” summarises Saffar.

[1] Source : The Space Downstream Sector – Challenges for the Emergence of a European Space Economy (IFRI, March 2022)